A breakthrough in solid-state battery technology promises to revolutionize electric vehicles with 500+ mile range and 10-minute charging times. Major automakers are racing to be first to market with this game-changing technology. The development could accelerate EV adoption faster than previously predicted.

The automotive industry stands on the cusp of a revolutionary breakthrough as solid-state battery technology moves from laboratory promise to production reality. This transformation could reshape the electric vehicle landscape more dramatically than any advancement since Tesla's first Model S.

Understanding Solid-State Technology Traditional lithium-ion batteries use liquid electrolytes to move ions between electrodes. Solid-state batteries, as the name suggests, replace this liquid with a solid compound, typically ceramic-based materials. This fundamental change brings multiple advantages: higher energy density, faster charging capabilities, improved safety, and longer lifespan. The technology eliminates the risk of battery fires associated with liquid electrolytes and allows for more compact packaging.

The Race to Production Toyota leads the charge, having announced plans to introduce their first solid-state battery vehicles by 2025. The Japanese automaker has filed over 1,000 patents related to the technology and claims their design achieves a 500-mile range with charging times under 10 minutes. Not to be outdone, Volkswagen-backed QuantumScape has demonstrated promising results in laboratory testing, while BMW and Ford have invested heavily in solid-state startup Solid Power.

Technical Challenges and Solutions Despite the promise, several technical hurdles have historically prevented solid-state batteries from reaching mass production. The primary challenge involves the interface between the solid electrolyte and electrodes, where resistance can impede ion flow. Recent breakthroughs in materials science have identified new compounds that maintain better contact during charging cycles. Additionally, researchers have developed manufacturing processes that can produce these batteries at scale while maintaining consistency and reliability.

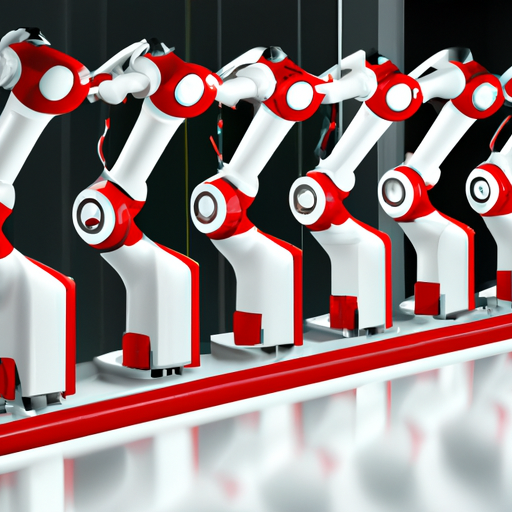

Manufacturing Scale and Cost The transition from laboratory to mass production represents perhaps the biggest challenge. Current estimates suggest solid-state batteries cost about eight times more to produce than traditional lithium-ion cells. However, automotive suppliers project these costs will decrease significantly with scale, potentially reaching price parity by 2028. Major investments in manufacturing facilities are already underway, with Asian battery giants like CATL and Samsung SDI developing dedicated solid-state production lines.

Impact on Vehicle Design Solid-state batteries' higher energy density allows for smaller, lighter battery packs while maintaining or increasing range. This creates new possibilities for vehicle packaging and design. Engineers can redistribute weight more effectively, improving handling and performance. The reduced cooling requirements also simplify thermal management systems, further reducing weight and complexity.

Market Implications The introduction of solid-state batteries could accelerate electric vehicle adoption beyond current projections. Range anxiety and charging time concerns, two primary barriers to EV adoption, would effectively disappear. Industry analysts predict solid-state vehicles could achieve cost parity with internal combustion engines by 2030, potentially marking the tipping point for mass EV adoption.

Environmental Considerations Solid-state technology offers environmental advantages beyond zero-emission driving. The batteries' longer lifespan reduces replacement frequency and associated waste. The manufacturing process requires less energy and fewer raw materials compared to traditional lithium-ion production. Additionally, solid-state batteries are easier to recycle, supporting circular economy initiatives.

Infrastructure Requirements The faster charging capabilities of solid-state batteries will require upgrades to existing charging infrastructure. Current DC fast-charging stations typically deliver up to 350 kW, but solid-state vehicles might handle 500 kW or more. Utility companies and charging networks are already planning for this transition, though significant investment will be needed.

Competitive Landscape The race to commercialize solid-state technology has sparked intense competition and collaboration. Traditional automakers partner with tech startups while also maintaining internal development programs. This has created a complex web of intellectual property sharing and strategic alliances. Success in this arena could determine market leadership in the next decade of automotive evolution.

Future Outlook As solid-state technology matures, its impact will likely extend beyond personal vehicles. Commercial trucking, aviation, and energy storage could all benefit from these advanced batteries. The technology might enable electric aircraft with practical ranges or grid storage solutions that make renewable energy more viable.

Conclusion Solid-state battery technology represents more than just an incremental improvement in electric vehicles - it's a paradigm shift that could accelerate the transition away from fossil fuels. While challenges remain, the combination of industry investment, technological progress, and environmental imperatives suggests we're approaching a tipping point in automotive history. The next few years will prove crucial as manufacturers work to translate promising laboratory results into real-world products.